Wells Fargo Advisors’ Envision innovative investment-planning process starts by helping us define your measurable goals. We then evaluate the likelihood that your goals would have been met, given ever-changing market conditions and your recommended investment plan. Using an advanced simulation methodology, the Envision process analyzes the delicate balance needed for you to make progress toward your goals, all while seeking to avoid unnecessary investment risk.

Using statistical modeling, the Envision process then simulates hypothetical market and economic scenarios to demonstrate the impact that different market environments would have had on your goals. With that information, we can adjust your investment strategy to reflect both realistic expectations and your goals.

Using statistical modeling, the Envision process then simulates hypothetical market and economic scenarios to demonstrate the impact that different market environments would have had on your goals. With that information, we can adjust your investment strategy to reflect both realistic expectations and your goals.

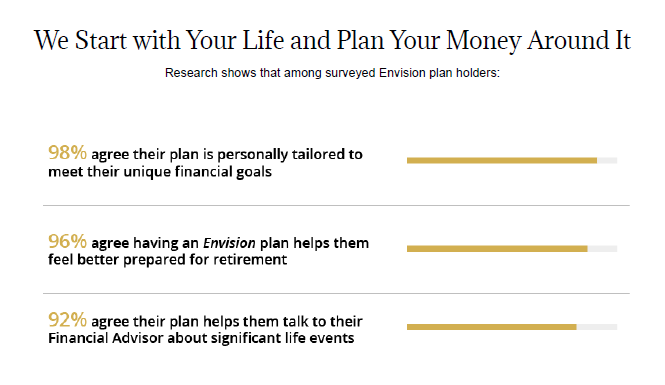

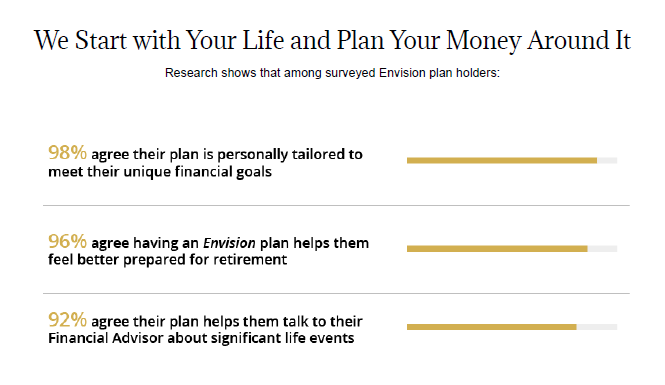

We Start with Your Life and Plan Your Money Around It

Research shows that among surveyed Envision plan holders: